| Interest rates are the cost to borrow money . They say everything about a currency and economics of countries : the former if it is attractive enough for investors , the latter if they are growing , and the pace of growth . Inflation happens when money is more disposable because of its low cost , so its demand go up to buy goods , whose prices will raise accordingly .To buy an asset , a person invest his own money , but speculators and professionals use to borrow money to invest : interest rates are their costs to do so . When interest rates are awaited to go up , their costs will go up , and their earnings will fall , if asset prices don’t continue to raise , and valuations can’t raise if enterprises pay more to borrow and feed their businesses . To hedge this risk , actors use futures and options . Moreover , trends in interest rates don’t change every day , but go on for decades , as economic cycles do too. |

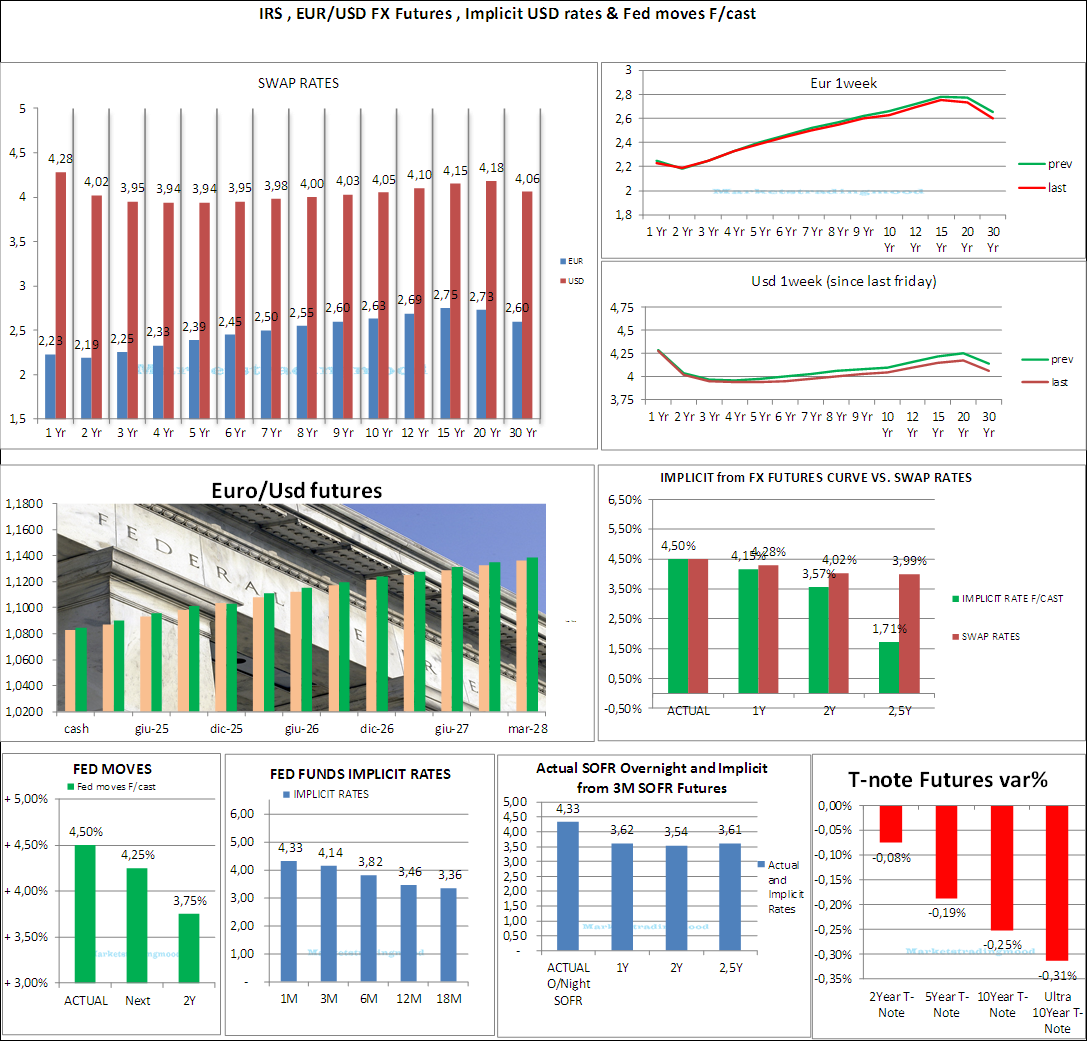

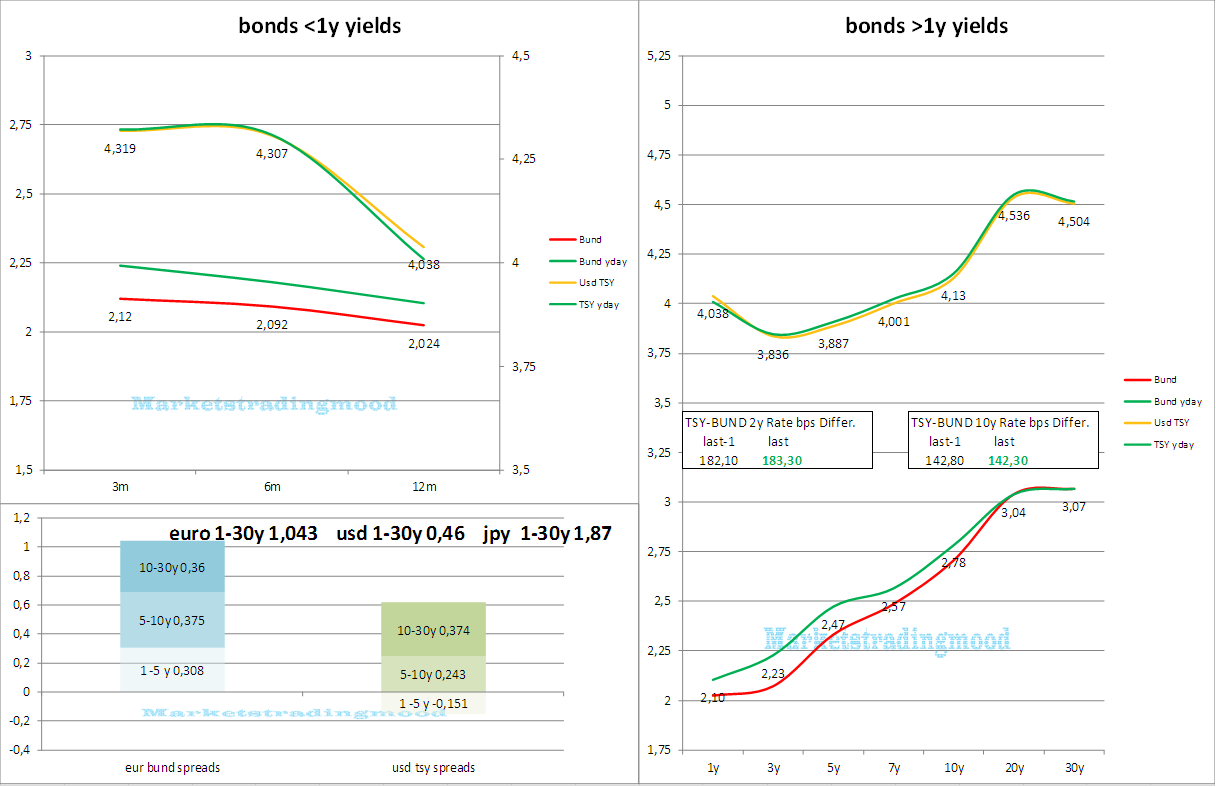

| Below a display of interest rates charts for USD and Euro . The dollar rates influence forward rates , and Fx futures , as shown below ; and depend on expectations about next FED steps too. |

Rates : current scenario

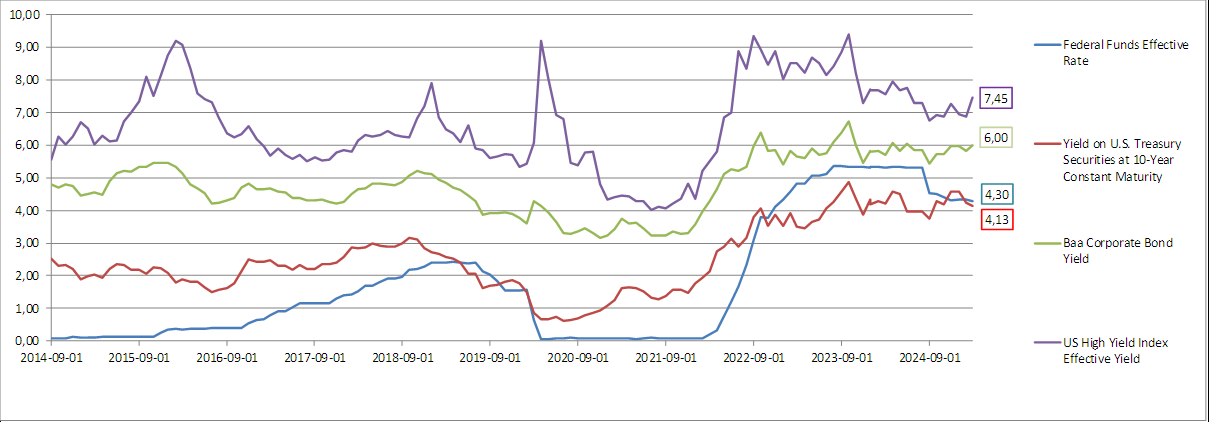

Yields : long-term trends

Holding a fixed rate bond

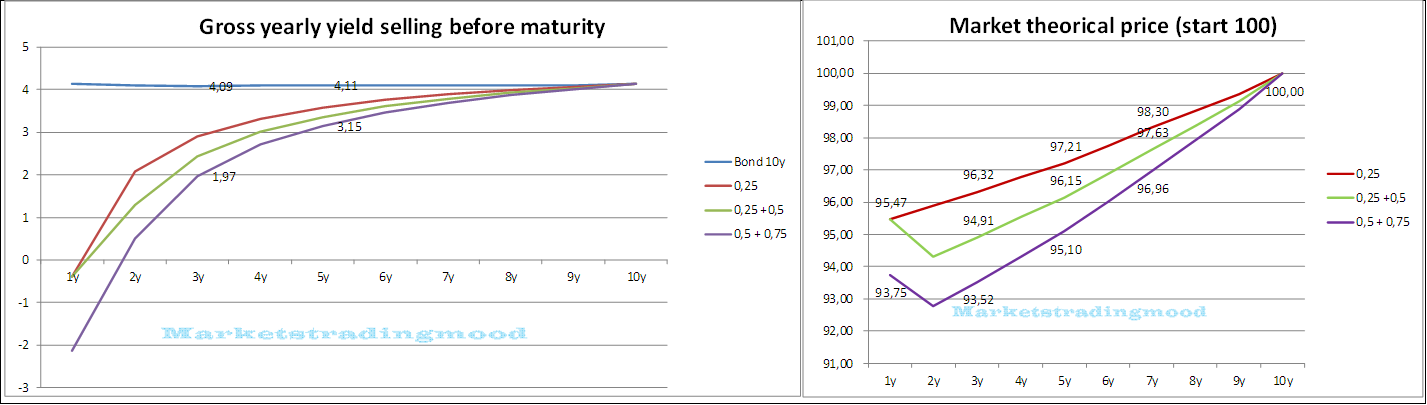

Below two charts : the right one , based on swap rates curve , show a 10 years bond’s theoretical yearly price from start to maturity . The left one , displays the annual yield gained selling the bond before maturity . It is comprehensive of coupons ,based on prices as above mentioned., not considering trading fees and , in case of capital gains , fiscal duties .Calculation of coupons is without reinvestment (not compounded).Three scenarios are provided . A 25 basis point rate increase , a 25 points increase followed next year by a 50 points increase ,an increase of 50 points followed by a 75 points increase next year .

Bond curves

Finally , curves’ structures for Euro and Usd gov.t bonds , with relative spreads within different maturities . When upper curves are in green colour , rates went down last day .

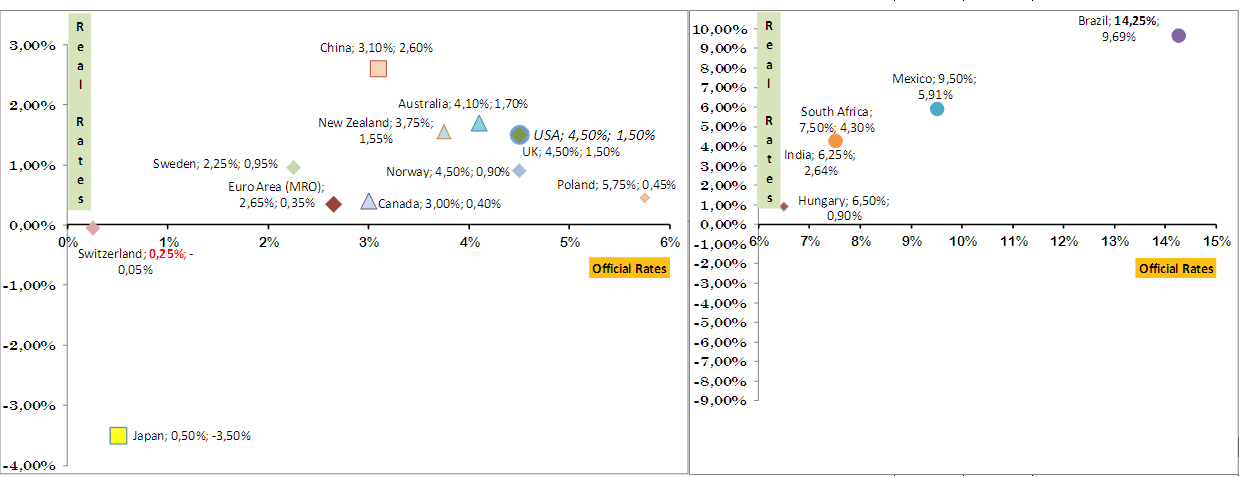

Official and Real Rates

The charts below show official and real (official minus inflation ) rates for each country . Updated weekly on Sundays , or during week , depending on Central Banks’ decisions ; last decisions are highlighted in red if downward , in bold if upward .