Before starting…

Please read carefully disclaimer page before reading site’s pages . Continuing in reading implies your full and unconditional agreement to disclaimer content . Site pages are daily updated around 09:00 am GMT . See also last updates on What’s new page .

Very Important!

Currency trends page now includes analysis on cryptocurrencies , the most capitalized and traded .That doesn’t imply an advice to trade cryptos , a very dangerous practice for your capital ; the only objective is to demonstrate that strategies based on markets’ actors behavior , in some periods can widely overperform particularly on those asset that are bought and sold on an emotional base , and this is the case of cryptocurrencies , whose value depends on ideas and previsions , having not a role as a national currency , nor backed by a material or safe background , or relying on a country’s economy ; and recent news about exchanges where these assets are traded show a lack of regulation in the matter , too .

Markets mood indicator

Indicators range from 0 to 100 .Overall from 0 to 50 indicates a negative mood , above 50 up to 100 a positive one . When Overall is very low (<25%) the odds of risky markets rebound are conversely high ; on the opposite side, an Overall reading above 75% likely shows risky markets’ overbought situation .

Last closing day

Last – 1 closing day

Dear Guest , we thank you very much for visiting our site ! Understanding the way financial markets evolve , has never been easy . We wish to walk with you along this path , putting our experience , about 35 years of passionate work in financial world , at your disposal , in order to build a better and non-conventional base for markets knowledge . Our effort will in reality consist in showing you , in a simple and clear manner , by over 250 charts and tables , what is behind the price movements , trying to derive from them the behavior of actors who are dealing and trading day by day .

What will you find?

In site’s pages , you’ll find various Analyses to go deep in markets’ mood ; to summarize their content , assets can be divided in two classes . Cyclicals , whose positive phase are sign of a better market sentiment , and Defensive , whose strenght signals a weak mood .

What’s on top of this page?

This page’s top shows actual phases ; prevailing red colors prelude to a risk-off stance ; prevaling green colors underscore a positive mood . Time frame of analysis is short term (1-3 weeks) .Underlying quotes are updated at last working day . For a most comprehensive markets’ assets analysis , see related menu pages.

Please contact us if you would like getting analysis on assets you are in addition interested in , email addresses are on Contacts page .

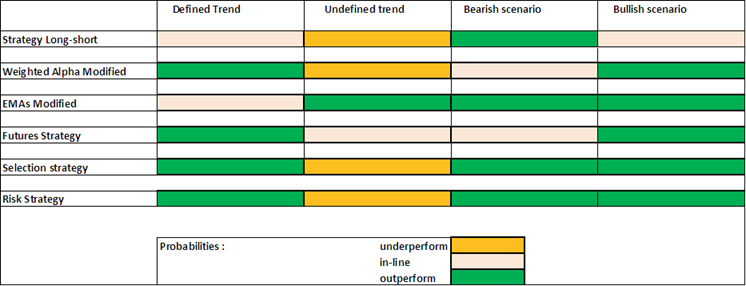

| Strategies are updated daily , and are : Long only : Selection strategy , Weighted Alpha Modified ; Long-short : Strategy long-short , EMAs (exponential moving averages) Modified , Futures strategy , Risk strategy . All strategies don’t utilize leverage . That’s why every scenario needs a different strategy ; as to say , every season has its favourite clothings . |

Probabilities in different trends

The following table and chart show the strategies’ year-to-date results .See also What’s behind page for strategies’background , and How to page for readings of performances and charts . Last changes in current positions are displayed on last column for each asset ( S > L from short to long , L > S from long to short) .

Strategies and Index trends

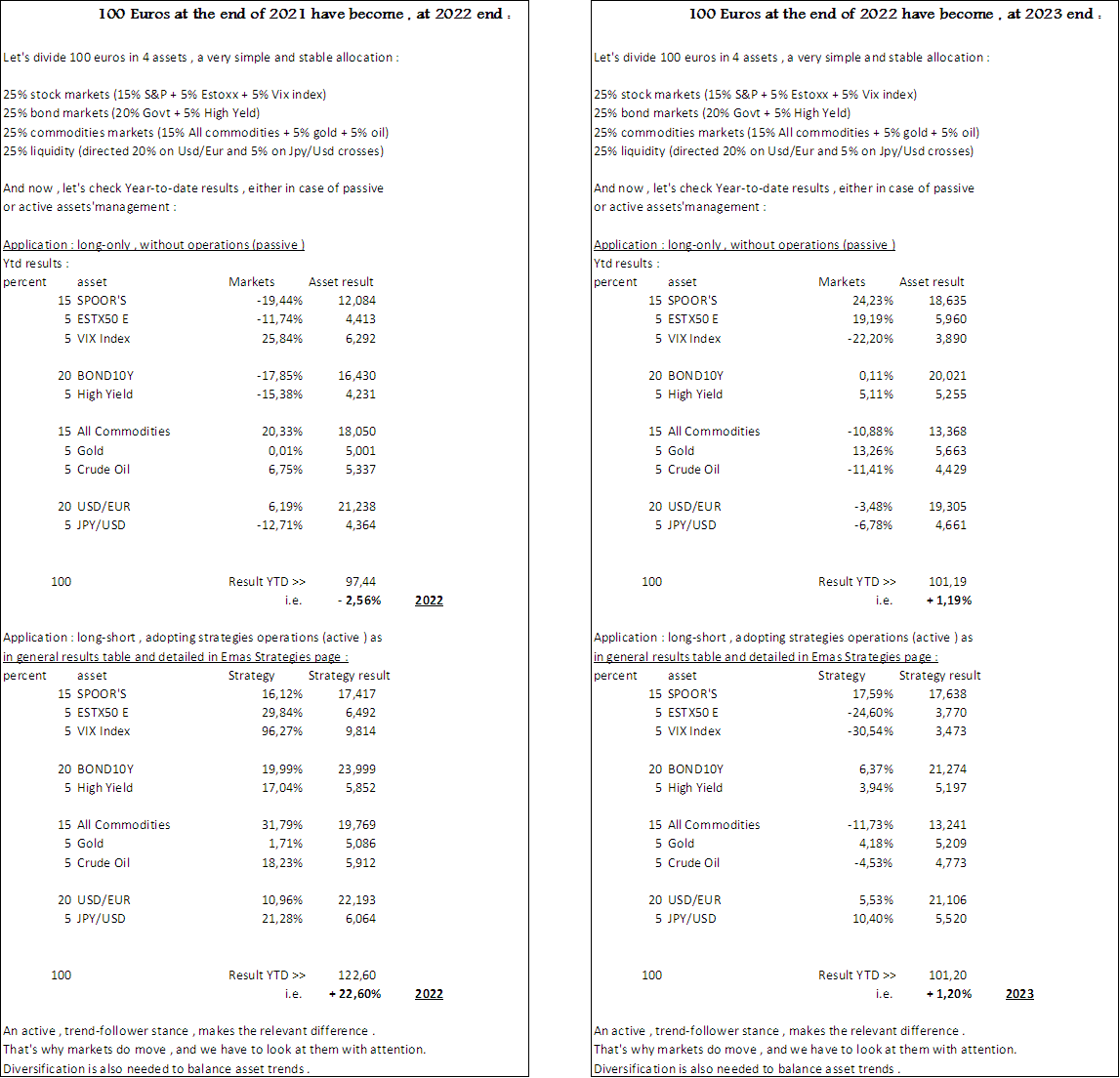

he table below presents a practical application .

Base and scale

All studies described on this site are based on proprietary algorithms , organized in spreadsheets and coded in VBA , with macro routines ; they can be easily converted in other languages (Python, R etc. ) . Every market sector has its relevant page , where points of intervention (buy and sell) are showed , to check how they work and when they act . For example , Equity Alpha page lists , at each week start , which stocks are selected . Futures page exhibits , for each day , positive or negative assets . Long-Short page shows which assets are selected on a weekly base , with relevant stop-loss prices , or prices to enter a long position . EMAs page , on a daily base , points out levels where opening or closing positions ; and so on .